Luxury Retailers Opting to Buy Iconic Buildings for Flagship Stores

A growing trend has emerged over the past year: luxury retailers are increasingly opting to buy rather than lease iconic buildings for their flagship stores in top global markets. This strategic move is transforming the landscape of luxury retail, offering brands greater control over their customer experience and long-term financial benefits.

Notable Acquisitions by Luxury Retailers

Several high-profile acquisitions exemplify this trend:

Kering:

The French fashion group, known for brands like Gucci, Brioni, and Balenciaga, acquired 715-717 Fifth Ave. in Manhattan for $963 million. This acquisition includes several multi-level retail spaces ideal for showcasing their high-end brands.

Prada:

In a landmark deal, Prada acquired 724 Fifth Ave. in Manhattan for $425 million. The Italian fashion house had been leasing five floors of this iconic building since 1997.

Potential Sale of 745 Fifth Ave.:

Manhattan’s 745 Fifth Ave., home to Bergdorf Goodman’s flagship store, is potentially up for sale to either LVMH or Chanel.

Kering in Milan:

Kering also purchased an 18th-century building on via Montenapoleone, Milan’s most exclusive shopping district, for $1.4 billion.

Enhancing Brand Recognition Through Ownership

Owning buildings in iconic shopping districts allows high-end retailers to create unique experiences that attract more customers. There’s a certain allure and prestige associated with shopping at a flagship store housed in an iconic building. For instance, while Manhattan’s Diamond District might offer better value for an engagement ring, it doesn’t provide the same social validation and credibility as buying from Tiffany’s flagship store on Fifth Avenue.

Building ownership significantly enhances brand recognition. Younger generations, especially Generation Z, seek authentic brand experiences. Growing up in the digital age with constant connectivity via social media has made them skeptical of artificial content, leading them to value genuine experiences when shopping. While a robust digital presence remains essential, the value of a brick-and-mortar store where products can be experienced firsthand is rising.

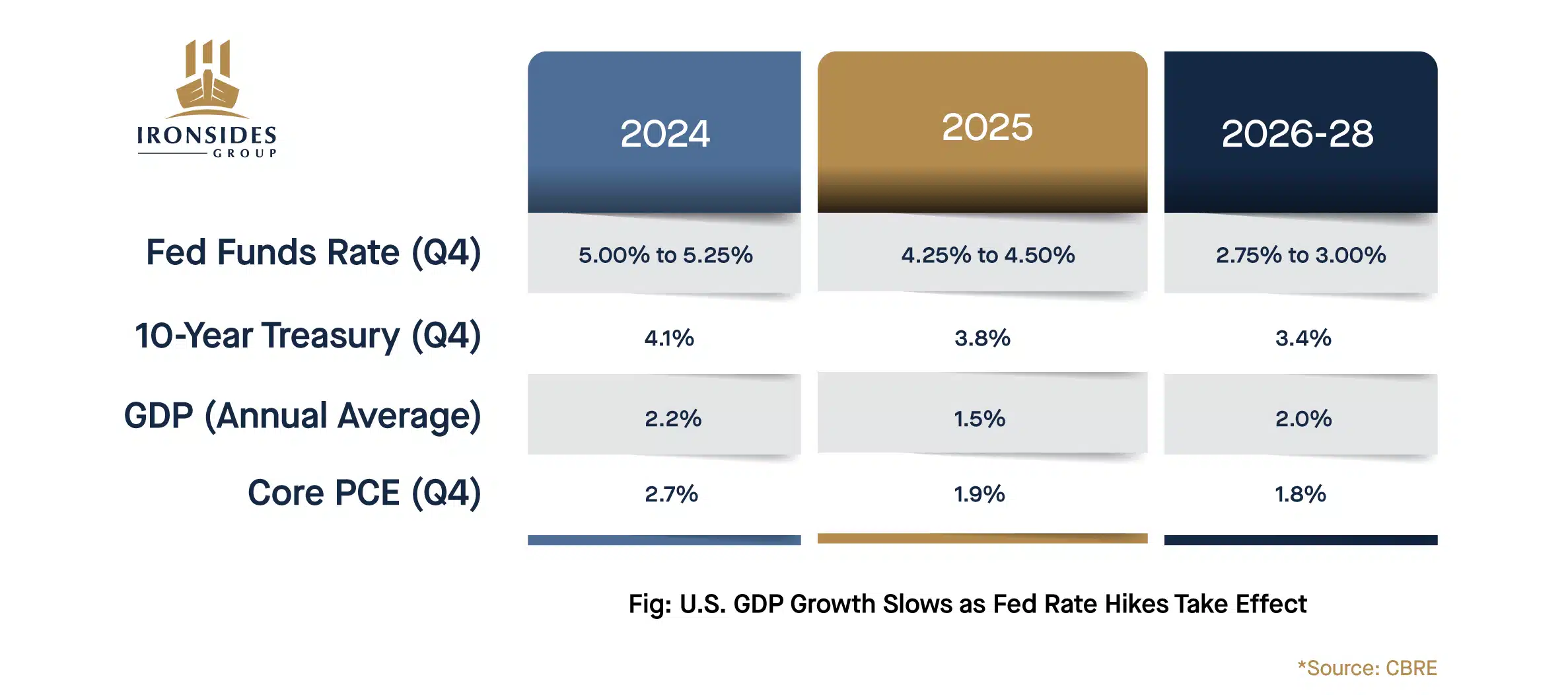

Economic Considerations Driving the Trend

Economic factors also play a crucial role in this trend. An analysis by Ironsides Group of Placer.ai data indicates that combined foot traffic in the top 10 prime retail districts in the U.S. should return to pre-pandemic 2019 monthly averages by Q4 2023. This revival is driving rent and building value growth along major high streets.

Acadia Realty Trust, in its Q1 earnings call, forecasted steeper rent growth for its high-street buildings compared to more traditional retail properties. As rents in the world’s most famous retail districts continue to rise, owning their buildings offers retailers more insulation from landlord-favorable market conditions.

Building Ownership: A Gateway to Omnichannel Strategy

By establishing a more permanent presence through building ownership, retailers can develop other channels to attract new customers and brand fanatics. Retail industry professionals generally agree that retailers need an omnipresent and omnichannel strategy.

This means being wherever their clients frequent. Luxury retailers are beginning to embrace this by marketing their brand through non-traditional channels such as food and beverage offerings and enhanced client membership programs.

With their retail space and brand firmly established along the world’s top shopping streets, more time and effort can be focused on these newer ventures, which have proven to be effective at elevating their brand among their customers.

Conclusion

The trend of luxury retailers buying rather than leasing iconic buildings for their flagship stores reflects a strategic shift aimed at enhancing brand recognition, providing unique shopping experiences, and securing long-term financial stability. As the retail landscape continues to evolve, building ownership will likely become a cornerstone of the luxury retail strategy, enabling brands to thrive in an increasingly competitive market.

By strategically purchasing iconic buildings, luxury retailers not only solidify their presence in prime shopping districts but also create a unique, authentic experience that resonates with modern consumers. This trend underscores the importance of blending traditional retail with innovative approaches to meet the evolving demands of luxury shoppers.